How To Teach Kids Where Are Money From

How to Teach Kids Well-nigh Money at Every Age

Last Updated: four/26/2022

Advertising & Editorial Disclosure

Quality Verified

Want your kids to practice better than you financially? Want them to keep a upkeep and invest in their future? Financial education is key.

A 2018 National Financial Capability Written report plant financial education correlated with practiced financial behavior like saving more than, spending less than you earn, and being less likely to overdraw a checking account. Information technology reported, "49% of respondents who received more than ten hours of financial didactics report spending less than they earn, compared to 36% among those who received less than 10 hours."

While information technology'southward never too tardily to learn, the earlier you learn financial literacy, the greater the long-term affect. That'southward why we've compiled money methods to teach your kids near finances at every age.

Toddlers

Kids beginning learning the moment they are born. Initially, this learning is fake based, like following a parent's lead to smile, track objects, and say their first words. Whether you know it or not, they are learning and picking up your habits.

Get-go early by setting a expert case for them to follow later. The habits they'll pick up include developing a upkeep at the grocery store, paying bills on fourth dimension, and resisting impulse buys. When you discuss your decision-making with your toddler, they'll learn how to make ameliorate decisions on what to (or not to) buy.

Preschoolers and Kindergartners

While kids at this age may not empathize the value of money, they should understand the demand to pay for merchandise. Kids learn from shared experiences, so include them in the grocery trip to assistance them sympathize this process. To make it more than tangible, leave the credit cards at home and utilize common cold hard cash.

By 7 years erstwhile, we develop basic fiscal behaviors, according to a University of Cambridge study. Earlier you panic and recollect your kids are already behind, they've probably addressed the basics: counting and exchange.

-

Counting

This starts with simply counting objects, but should abound to include counting coins and dollars. Show kids the different kinds of coins and bills, allowing them to recognize the differences, grouping them, and then count that specific set. -

Substitution

I of the hardest lessons to learn at this age is that something must exist given upward to make a buy. Money tin can but be spent one time. To teach this, requite a child ane dollar to spend in the store and focus on choosing an particular they really want. The child must manus over that dollar to purchase the detail and experience the commutation of goods.

Kickoff to Fifth Class

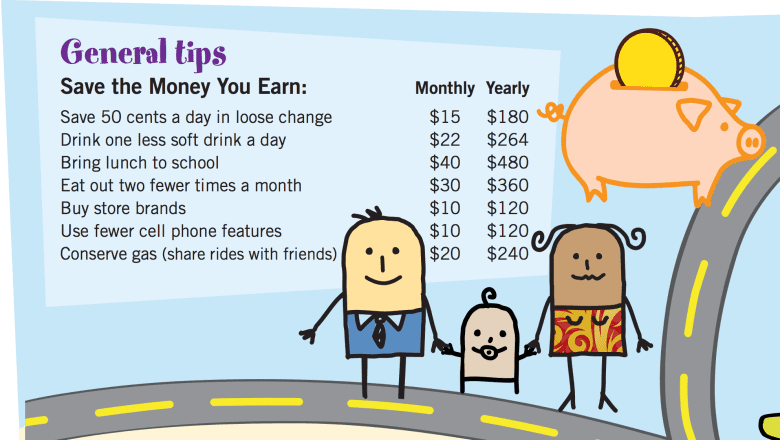

Source: Junior Achievement

With a basic understanding of the purchasing ability of money, your class-schooler probably now wants more. It's time to explain how to earn coin, salvage it, and what opportunity costs are. The Federal Deposit Insurance Corporation (FDIC) has classwork suggestions to help teach these principles at schoolhouse or home.

-

Earning money

Unfortunately, your mother was right and money does not grow on trees. It is earned, and for kids at this age, it should be earned with chores. Rather than an allowance, reward work with personal funds. This teaches the ultimate lesson in finance: it takes piece of work to earn coin.Kids who earn their allowance are in the majority. A Junior Achievement U.s.a. survey found 82% of the children earned an allowance for doing chores, getting good grades, doing homework and just being kind to others at school and at home.

-

Saving

It'south time for a piggy banking concern or perhaps a mason jar, instead. A clear mason jar allows a child to see the coin grow over time. Information technology helps reinforce the benefits of saving. It'due south also important to introduce children to the benefits of banks. Have them to the bank with you to deposit money, explaining the benefits of saving money there versus at domicile. Most banks and credit unions offering savings accounts for children — and many pay involvement on deposits.It's also important to explain why you save: short-term needs, long-term goals and establishing an emergency fund. Provide scenarios to explain how you save and why. Honesty volition help them learn and capeesh existent-earth finances.

- Opportunity cost

A fifth-grader should be able to understand opportunity cost, even if you lot don't apply that term. Opportunity price is the loss of potential gain from other alternatives when ane alternative is called. You can aid your kid empathize impulse buying versus long-term goals. It'southward a constant boxing that we begin learning at this phase. Explicate the difference between needs and wants, and how to prioritize them. We all have impulse buys, but we must learn to recognize them and limit them.

Sixth to Eighth Grade

At this phase, y'all've established a lot of great money principles for your eye-schooler. The next stages focus on expanding on those nuts concepts with income, budgeting and delectation.

-

Income

What practice you want to exist when you grow up? The question at younger ages elicits a cute response. By middle school, though, it'south a real conversation about the need to observe a career that will support you lot for a lifetime. Explore different job options and discuss both their responsibilities and their paycheck. This is also a practiced opportunity to explain why your bacon isn't how much yous have dwelling house. Explain taxes, Social Security, insurance premiums, and other deductions from your paycheck. -

Budgeting

While your kid doesn't demand a personal upkeep right now, it's a practiced idea to acquire how to set one. Include them in your budgeting, asking for input on financial decisions similar meal planning for the grocery budget. -

Contentment and giving

"Mark got a new iPhone. I need one as well!" It'due south easy to compare ourselves to others, and for pre-teens and teenagers, the pressure is even greater. Kids at this age demand to learn contentment — being satisfied with what they have rather than trying to keep upward with the Joneses. Even better, they demand to learn to appreciate what they do have. If they don't already, kids should understand the benefits of giving dorsum and altruistic to charity. Volunteering or altruistic items is a proficient lesson for all of us.

Looking to check your kid's financial literacy progress? Jump$tart Coalition created national standards for educators to set financial literacy goals. It's a skillful goal for parents also. The benchmarks by eighth form include:

- Set spending priorities to reflect goals and values.

- Discuss the components of a personal spending program, including income, planned savings and expenses.

- Compare saving strategies, including "Pay Yourself Start" and comparison shopping.

- Illustrate how inflation and interest tin affect spending ability over time.

- Justify the value of an emergency fund.

High-Schoolers

Teenagers are looking for and need new levels of independence. It's non long before they are off on their ain. Many of the lessons at this stage are firsthand experiences with a checking business relationship and budgeting for college.

-

Personal accounts:

While your teen may not use the traditional check register you learned with, every teen needs to know how to balance a checking account. Personal checking and savings accounts do not establish credit, simply they practice show an ability to handle your finances. While a checking account is all a teenager technically needs, it'due south a skillful idea to open a savings business relationship likewise (if y'all haven't done then already) so they tin can include deposits to both accounts in their budget and see immediate the impact of compound interest. -

Credit cards:

Our society relies heavily on credit cards, which can take their benefits. However, they may too include high fees and interest charges, even more so for those with limited or no credit history. Teenagers must learn the dangers of credit cards and how to utilise them wisely. Teach them to pay off the remainder and avoid buying things they can't pay off each month. A good way to explain involvement charges is to look at the interest a banking concern pays you on a savings business relationship versus what a credit carte du jour charges you lot to use their money. Investigate student credit cards together to learn which one is the right one for your teen.

More than: Do Debit or Credit Cards Brand Sense for Your Child?

- Paying for higher:

The toll of higher is skyrocketing, and so is student debt. As you and your teenager prepare for the next step, compare the costs together, and discuss how yous're going to pay for college. Not every high schooler needs to go to college, and some schools are much more expensive than others. Forth with college options, research available scholarships and loans. The decisions you brand now will influence the rest of your life.

Learning how to handle money is a lifelong process. Still, the earlier your child embraces good financial habits, the more likely they are to discover financial success.

About the Author

Source: https://www.moneygeek.com/financial-planning/resources/how-to-teach-your-kids-about-money/

Posted by: hallgliver.blogspot.com

0 Response to "How To Teach Kids Where Are Money From"

Post a Comment